Deregulation - Executive Summary

Treasury Secretary Scott Bessent has suggested deregulation will put the US “on a new growth trajectory.” ARK Invest CEO Cathy Wood has said deregulation will prove “rocket fuel” for the US economy. In late June, WSJ columnist James Freemen even credited deregulation for the march of US equities to all-time highs despite continued trade-war uncertainty: “The fuel for optimism is the understanding of how large a footprint the federal regulatory apparatus places on the neck of the U.S. economy and therefore how significant is the relief when Washington simply signals that it intends to let Americans drill, mine, manufacture, finance and invent in peace.”

Such lofty declarations tweaked our contrarian nerve and inspired us to write this report—our first as an independent research firm. It’s clear that deregulation is poised to be a return-defining theme of the Trump presidency. But it’s also clear that misguided assumptions will lead to losing investments. So, we dug into history and academic studies. We dug into Trump 1.0’s track record and the actions already underway by Trump 2.0. Will the deregulatory reality match the hype? What can the administration actually achieve and what will it mean for the US economy and winner/loser dynamics across asset classes and sectors?

These were the questions that shaped this report. Undoubtedly, deregulation will continue to inspire rampant misconceptions. That is key to the opportunity we see—through nuance, investors can realize alpha by exploiting price disconnects built on misconceptions. This report aims to be a strategic roadmap, pinpointing key macro and micro implications of the Trump administration’s deregulatory agenda.

Deregulation was not always a politically divisive aim. Ronald Reagan is credited with the deregulation wave of the 1980s. However, it actually began under Jimmy Carter with the passage of the Airline Deregulation Act (ADA) in 1978. Distrust of government and big business was a hallmark of the countercultural movement on the left in the late 1960s and throughout the 1970s. Regulation became a target of that distrust. As California Governor Jerry Brown, a Democrat, said in his second inaugural address in 1979: “Many regulations primarily protect the past, prop up privilege, or prevent sensible economic choices.”

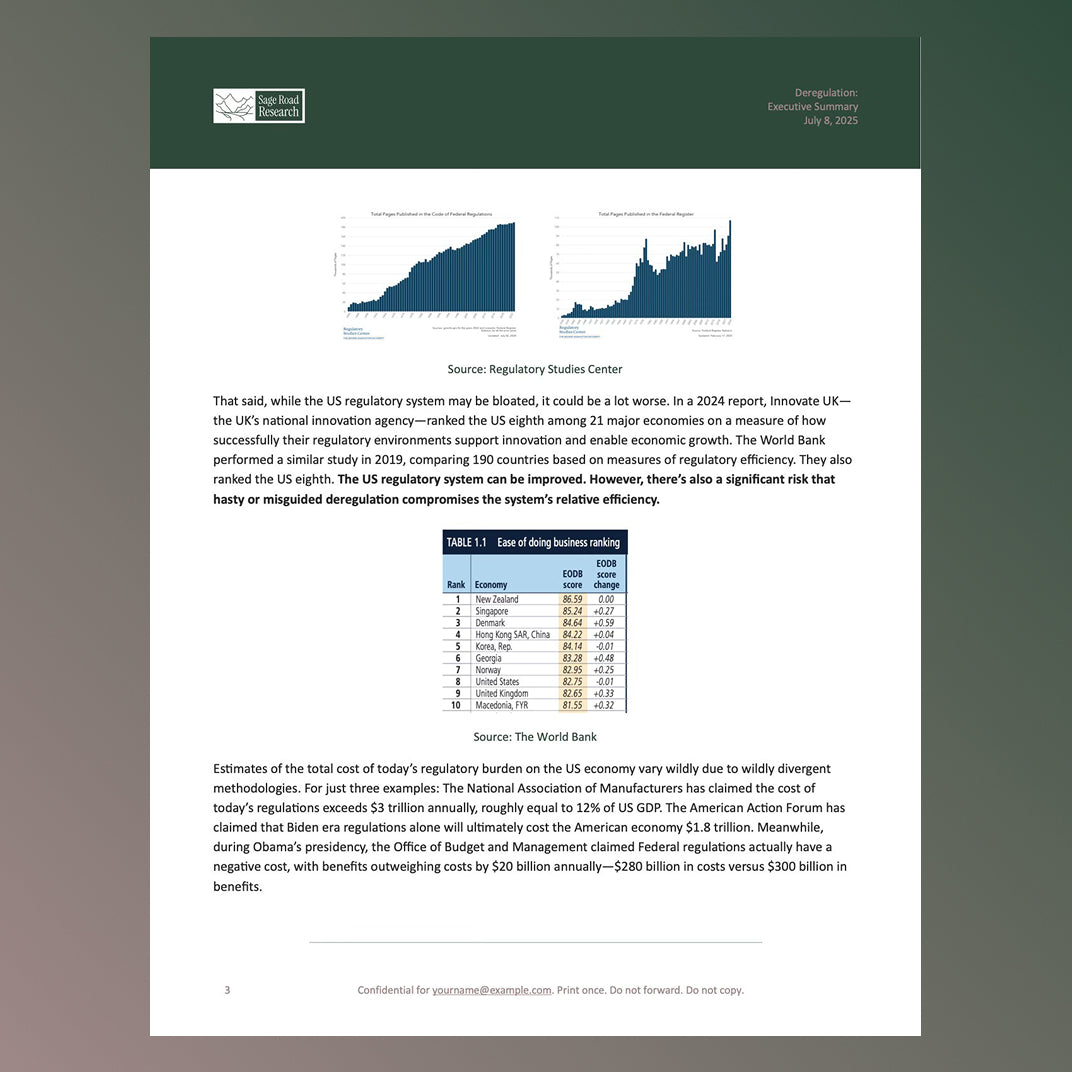

Regulatory expansion over the past three decades deserves scrutiny. The steady increase in the number of total pages in the Federal Register—which now exceeds 180,000 pages—suggests excess and inefficiency. It’s a natural progression: Economic growth and innovation yield new risks that regulators respond to with new regulations. Then companies find ways to circumvent those regulations, which causes more layers of new regulation. And the longer this progression continues unimpeded, the more redundant, outdated, and counterproductive regulations stymie economic dynamism while yielding inadequate economic or societal benefit, necessitating house cleaning.

Source: Regulatory Studies Center

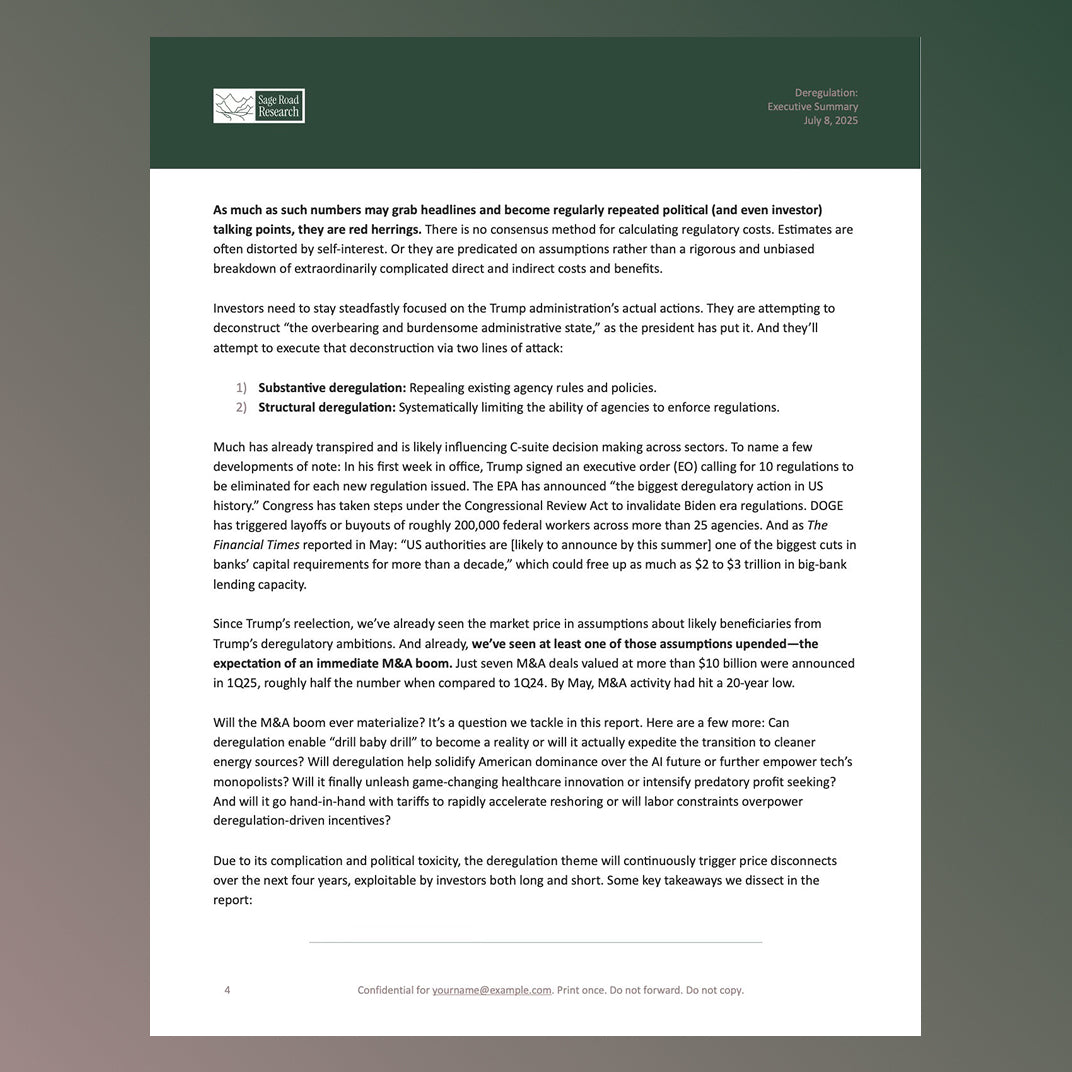

That said, while the US regulatory system may be bloated, it could be a lot worse. In a 2024 report, Innovate UK—the UK’s national innovation agency—ranked the US eighth among 21 major economies on a measure of how successfully their regulatory environments support innovation and enable economic growth. The World Bank performed a similar study in 2019, comparing 190 countries based on measures of regulatory efficiency. They also ranked the US eighth. The US regulatory system can be improved. However, there’s also a significant risk that hasty or misguided deregulation compromises the system’s relative efficiency.

Source: The World Bank

Estimates of the total cost of today’s regulatory burden on the US economy vary wildly due to wildly divergent methodologies. For just three examples: The National Association of Manufacturers has claimed the cost of today’s regulations exceeds $3 trillion annually, roughly equal to 12% of US GDP. The American Action Forum has claimed that Biden era regulations alone will ultimately cost the American economy $1.8 trillion. Meanwhile, during Obama’s presidency, the Office of Budget and Management claimed Federal regulations actually have a negative cost, with benefits outweighing costs by $20 billion annually—$280 billion in costs versus $300 billion in benefits.

As much as such numbers may grab headlines and become regularly repeated political (and even investor) talking points, they are red herrings. There is no consensus method for calculating regulatory costs. Estimates are often distorted by self-interest. Or they are predicated on assumptions rather than a rigorous and unbiased breakdown of extraordinarily complicated direct and indirect costs and benefits.

Investors need to stay steadfastly focused on the Trump administration’s actual actions. They are attempting to deconstruct “the overbearing and burdensome administrative state,” as the president has put it. And they’ll attempt to execute that deconstruction via two lines of attack:

- Substantive deregulation: Repealing existing agency rules and policies.

- Structural deregulation: Systematically limiting the ability of agencies to enforce regulations.

Much has already transpired and is likely influencing C-suite decision making across sectors. To name a few developments of note: In his first week in office, Trump signed an executive order (EO) calling for 10 regulations to be eliminated for each new regulation issued. The EPA has announced “the biggest deregulatory action in US history.” Congress has taken steps under the Congressional Review Act to invalidate Biden era regulations. DOGE has triggered layoffs or buyouts of roughly 200,000 federal workers across more than 25 agencies. And as The Financial Times reported in May: “US authorities are [likely to announce by this summer] one of the biggest cuts in banks’ capital requirements for more than a decade,” which could free up as much as $2 to $3 trillion in big-bank lending capacity.

Since Trump’s reelection, we’ve already seen the market price in assumptions about likely beneficiaries from Trump’s deregulatory ambitions. And already, we’ve seen at least one of those assumptions upended—the expectation of an immediate M&A boom. Just seven M&A deals valued at more than $10 billion were announced in 1Q25, roughly half the number when compared to 1Q24. By May, M&A activity had hit a 20-year low.

Will the M&A boom ever materialize? It’s a question we tackle in this report. Here are a few more: Can deregulation enable “drill baby drill” to become a reality or will it actually expedite the transition to cleaner energy sources? Will deregulation help solidify American dominance over the AI future or further empower tech’s monopolists? Will it finally unleash game-changing healthcare innovation or intensify predatory profit seeking? And will it go hand-in-hand with tariffs to rapidly accelerate reshoring or will labor constraints overpower deregulation-driven incentives?

Due to its complication and political toxicity, the deregulation theme will continuously trigger price disconnects over the next four years, exploitable by investors both long and short. Some key takeaways we dissect in the report:

- The Trump administration is likely to disappoint with both the scale and pace of its deregulation achievements.

- Nonetheless, we believe deregulation will contribute to higher growth, but also higher inflation, driving up bond yields.

- It will increase competitiveness in some sectors while exacerbating concentration problems in others, which will contribute to exploitable dispersion across equity, fixed income, and private markets.

- We see compelling opportunities ranging from mid-cap stocks to real assets, natural gas, biomedical innovation, and AI innovators enabling efficiencies in deregulating industries. That said, opportunities will be idiosyncratic.

Full report available below ↓

Sage Road Research

DEREGULATION